Schaffhausen makes business thrive!

Schaffhausen - the "area for makers" - offers the perfect conditions to establish and grow your European footprint. Schaffhausen offers one of the lowest effective tax rates for SMEs, and maintains OECD Pillar 2 compliance for large firms while providing support for research and innovation activities. Together with affordable business costs and an appealing cost of living, Schaffhausen provides a stable financial foundation for growing companies.

A tax environment that helps you thrive

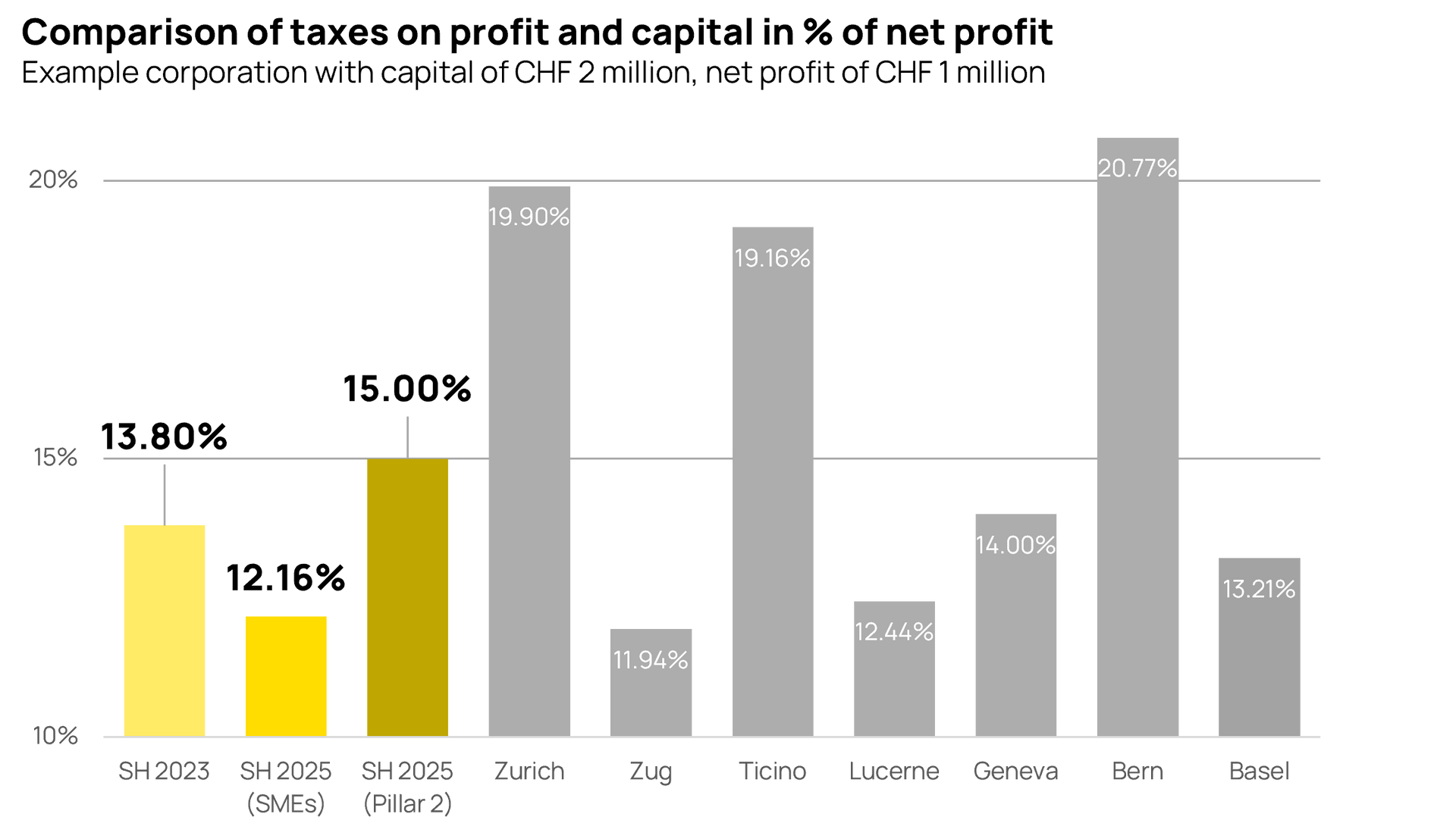

With a combined effective tax rate of 12 to 12.5% for small and medium sized enterprises, Schaffhausen is one of Switzerland’s top business locations.

For major international companies, Schaffhausen maintains compliance with the OECD Pillar 2 minimum taxation requirements, with a combined effective tax rate of 15%. Further tax instruments, including the patent box, R&D deductions, transitional rules, and step-up, are available. Tax incentives may also be possible for investments that create or preserve jobs in the Canton of Schaffhausen.

As a smaller Swiss canton, Schaffhausen provides the opportunity for early and close communication with the tax authorities. We will facilitate early-stage involvement in your relocation or expansion to discuss your tax planning and compliance.

"The overall environment and quality of life were exactly what we were looking for."

A financially advantageous place to live

For employees and business owners, both the cost of living and personal taxation are highly competitive with other Swiss cantons, making Schaffhausen a desirable place for leadership and talent.

Unlike most of Switzerland’s economic hubs, Schaffhausen’s housing market – both for rental property or homeownership – is diverse and affordable. Whether you’re looking for an urban high-rise apartment or a single-family home in a quiet neighborhood, you can find it here.

Affordable Business Costs

The cost of office space, as well as laboratories and production, is more affordable in Schaffhausen when compared to other cantons in Switzerland. Schaffhausen offers a range of quality options only 35 minutes from the city of Zürich and 40 minutes from the Zürich airport.

There is more

Schaffhausen newsletter

New to Schaffhausen or been here awhile? Stay up to date with our newsletter!

Welcome to the area for makers - you'll be hearing from us soon with exciting updates from Schaffhausen.

An error has occurred, please try again.